November 08, 2016 The money management system that works for me

Let’s face it, we’re fast becoming a cashless society.

With the advent of payWave and the like, we tend to carry less actual ‘cash’ in our wallet these days.

Now, here’s the problem.

With money flying here, there and everywhere, digitally speaking, it becomes increasingly hard to keep track of where it all goes.

Unlike hard cash.

Often before you know it, you’re left with a big hole in your budget.

If you have a particular financial goal you’re working towards – whether that’s saving for a house or an investment – the key is to commit to a simple, easy-to-stick-to money management system to stay on top of your spending.

How we lose track

Even the most organised people can get a bit disorganised with money.

A lot of people simply have too many accounts, with multiple credit cards, accounts and banks.

They also often throw all their money into an ‘everyday transaction’ account, hoping there’ll be savings left over from their monthly spending.

Lastly, it’s easy to get into the habit of paying bills without actually keeping track of a budget.

If any of those points are ringing a bell, the first step is to get organised.

With a little budgeting, effort and tracking, getting on track’s easier than what you might think. The key is the system.

The money management system, itself

The good news is that you don’t have to be a financial expert. Just willing to stick to a plan.

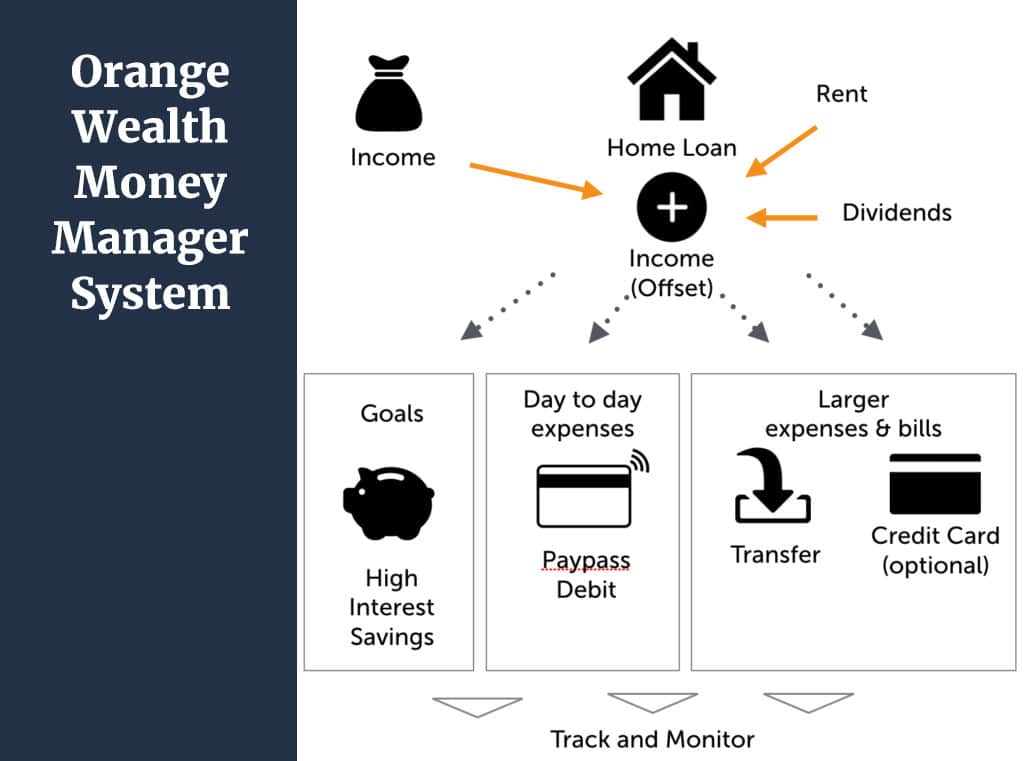

Here’s the four-step money management system that’s worked for me over the past few years…

Three accounts, tops

Cull everything back to just three accounts. What’s more, each should have a specific purpose.

The first should be your ‘income’ account.

This should be dedicated to your salary and other income, such as rent from an investment property. If you have a home loan, an offset account would be perfect for this. Same goes for an ING Everyday account, for example, which will give you a higher interest rate. All your bigger bills, such as loan repayments, utilises, car payments and the like should also come out of this account.

The second is a ‘day to day spending’ account, which should have a Visa Debit Card.

This should be used to withdraw ‘cash’ and pay for smaller items.

The third is a ‘savings’ account and should be a high-interest one.

This should be used specifically for savings – like putting money aside for your children’s education or a holiday, for example.

Work out your spending

Here, working out what you spend week-to-week and month-to-month is crucial.

Journalling everything is a great place to start. You’ll find a plethora of budget-style spreadsheets online to get going. Same goes for apps, which is what works for me.

Lastly, calculate an allowance that weighs up your day-to-day spending versus paying bills (both large and small). What’s important here is that the amount is enough for you to get by, while not spending more than what you have.

Healthy cash flow

As discussed, all income will come into your ‘income’ account and you’ll have your ‘allowance’, whatever that amount is.

(For the purpose of keeping things simple, we’ve intentionally left credit cards out, as the intention here is to start getting on top of everything, financially speaking.)

By way of a direct debit, first set up for your allowance amount to be paid into your ‘day to day spending’ account. Weekly, fortnightly, monthly – whatever works for you. The key here is to help you get your head around the reality of what you’re spending, day to day. Once you start to get an idea, chances are you’ll need to adjust this amount accordingly.

Then, set up a direct debit out of your ‘income’ account to support your ‘savings’ account. If you’re saving for a holiday, for example, it might be a case of sticking $150 into this account each week.

Here’s what a healthy cash flow should look like:

- Essential expenses – 60 percent: As the name suggests, these relate to everything you can’t live without. Namely shelter and utilities, groceries, healthcare, travelling to work and getting around, education costs, etc.

- Savings and interest – 20 percent: This should be set aside for unplanned emergencies, anything else you’re saving up for, or retirement.

- Discretionary spending – 20 percent: This should be for household and personal expenses such as dining out, clothing, personal care items, gym memberships, etc. Ultimately, this is the category that you should focus on shifting your spending behaviour.

And below will give you a bit of a snapshot as to how it all works…

Staying on top of it all

Having a system’s one thing. Making it work over the long term’s another.

Once it’s established, the key is to embed the system in your life. For me, there are three important considerations here:

- Track your spending: without having the data in front of you, it’s hard to form better spending habits. Once you know the lay of the land, so to speak, keep track of which category each expenditure is going toward. From there, calculate how much of your ‘income’ is going to each category.

- Adjust your allowance: You’ll likely need to adjust your allowance up or down over the first few months. Just until you get a real handle on everything. Over the longer term, your allowance will simply become a mechanism to ensure your money’s going towards your more important life goals and objectives.

- Try to stick to the 60/20/20 rule: It can be difficult, I know, but this is the ultimate goal, spending wise, for each category. If any of them start to go above the average, you may need to start employing some money-saving measures in the category that’s consistently going over.

Again, all this is easier said than done. Initially, it took me a little while before it started to become habitual. Once it did, though, I’ve never looked back.

For me, it’s been invaluable in striking that balance between enjoying the life with my family, stretching our income further and, ultimately, making sure we’re well and truly covered in the future.

Beyond everything I’ve outlined here, feel free to drop me a line if there’s anything you’d specifically like to know, as always.

Disclaimer: all information contained within this article is of a general nature. It does not take into consideration your personal financial circumstances. Please consult a professional financial adviser (just like us 🙂 ) when making a financial decision.

The top 7 financial goals for young families and how to set your own - | OW

Posted at 14:22h, 26 September[…] Get more organised and be smarter with […]