February 15, 2017 4 things you must know about life insurance

Insurance.

We all need it in one form or another, whether that’s for the house, the car, or the family dog.

Often, it’s a case of protecting our hard-earned assets and, like in the case of pets, minimising the blowout of (vet) bills.

Add health insurance for the family to the bill, and it starts to get expensive.

Interestingly, though, there’s one form of insurance that many people typically overlook – life insurance.

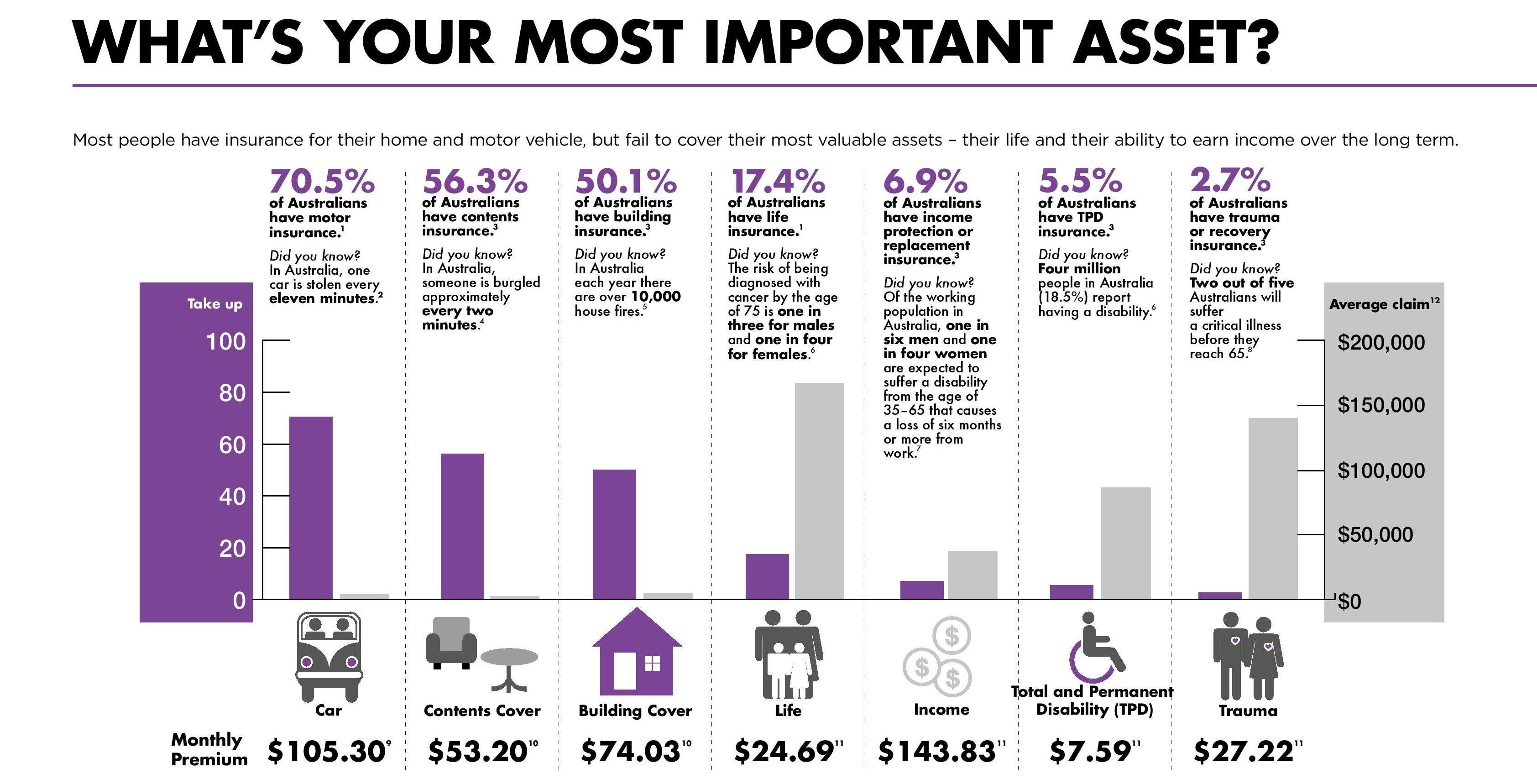

In fact, the statistics point to Australians being perennially uninsured when it comes to insuring themselves.

To be fair, it can be a bit of stretch for most people when you weigh up the combined premium leaving your account each month.

For me, it’s pretty straightforward.

Having a young family, one income (as my wife’s currently on career leave with our two girls), a mortgage, saving for our kids’ education needs down the track and, importantly, wanting to protect our lifestyle in the event that something unforeseen happens.

The more responsibilities I’ve taken on in life, the more insurances I’ve taken out.

Not so much for me, but for my family.

Do you actually need it?

Well, that’s the big question – and an important one you need to ask yourself.

I’d argue that if you have people depending on you financially, have a large debt, or have a family history of illness, the answer would be a resounding ‘yes’.

Now, the insurance industry is a complicated beast, as all the various products and their respective features can be quite difficult to get your head around. Meaning, if you don’t have any experience and don’t know what you’re looking for, you’ll invariably be left without the right cover, or worse, completely inadequate cover.

Getting the right cover and potential payouts when something does go wrong can go a long way to protecting your family’s lifestyle.

Hence why getting professional advice is so important.

The breakdown

Okay, so what is ‘life insurance’?

The term’s effectively an umbrella, which actually encompasses four ‘personal insurance’ products.

Here, I’ve listed them from absolute worse-case scenario to least worse-case scenario.

Life insurance

If you pass away or are diagnosed with a terminal illness, this is typically paid in a lump sum to your beneficiaries, namely your dependants.

For me, this one becomes particularly important the more financial commitments and debt you take on.

Here, your family could use this to pay off the mortgage, or even invest that money to generate an income down the track.

Total and permanent disability

If an illness or injury leaves you permanently disabled and never able to work again, this provides your family with the necessary financial support when the family needs it most.

As with life insurance, it pays a lump sum benefit and can be used to pay down a mortgage or generate future income.

Trauma

This pays a lump sum in the event that you suffer a serious medical condition.

While policies vary from product to product, the majority cover around 40 ‘specified’ conditions, including cancer, heart attack, stroke, Alzheimer’s disease and major organ transplants, for example.

The payment can be used to cover medical and rehabilitation costs, costs of alterations to your home if required and to help pay down your mortgage to ease the financial burden on your family.

Income protection

As the name suggests, this is to protect your income in the event that you fall ill or get injured.

This one’s an absolute must-have if you have a family depending on you. Typically, these policies pay a monthly benefit that equates to about 75 percent of your regular salary.

Better still, premiums are a tax deductible. That said, any benefits paid will be treated as income and, in turn, subject to appropriate tax rates.

What to consider

There are a few important things to get your head around.

Below, I’ve outlined 4 things you must know about life insurance.

These key points to consider are purely intended as very top-line commentary.

How much you’ll need

- You can insure yourself for up to 75 percent of your salary, through income protection.

- To work out life insurance specifically, you’ll need to take into account a variety of factors, including the amount of money your family will need to clear your debts, the cost of your kids’ education, any potential income for your spouse or child-care support, and your funeral costs.

- To work out total and permanent disability insurance, you’ll need to take into account the income you’ll need to live off (depending on your income protection insurance), any potential home alterations required to accommodate your disability, the amount of debt you have and your kids’ education costs.

- For trauma insurance the typical rule of thumb is up to two years’ income.

As to when you should take these out, the best time is when you’re fit, healthy and able.

Unfortunately, most people leave it until there’s a trigger, whether that’s something that happens to them or a loved on.

Source: ‘Protection and peace of mind for life’ Comminsure.

What it’ll cost

- You need to find a balance between covering yourself against the risk of something unexpected happening versus what you can actually afford.

- When considering costs, the important thing to ask yourself is this: what’s your most important asset? I’d argue that’s you. Touch wood, let’s say you get injured at 45 and can never work again. You’ll need a way to support your family for the next 20 years.

- The costs obviously depend on your personal situation, so please simply treat these as a bit of a guide.

Deciding which product’s right for you

Regardless of which insurance provider you’re looking at, you’ll need to weigh up considerations such as:

-

- the actual cost of the policy,

-

- insurance claims you’ve made in the past,

-

- whether a particular product’s features fit your circumstances,

-

- who your beneficiaries are,

-

- tax implications,

-

- whether there are loyalty bonuses,

-

- deciding between ‘agreed or ‘indemnity’ income protection,

-

- the fact that some insurers treat certain jobs and vocations differently, and

- whether you’ll pay for it through your super or cashflow.

Regular reviews

Bear in mind that your needs will change over time and that you’ll need to reassess, periodically, the amount of cover you’ll need and adjust your policy accordingly.

Be sure to shop around, as you’ll want to make sure your policies are competitive with other ones out there.

Never cancel any existing policies until the new ones are set up.

As I mentioned earlier, insurance is a rather complex area and, again, everything I’ve outlined here just scrapes the surface, particularly given that everyone has their own unique circumstances.

If there’s anything else you’d like to know or you need some more pointed advice, feel free to give me a shout.

Disclaimer: all information contained within this article is of a general nature. It does not take into consideration your personal financial circumstances. Please consult a professional financial adviser (just like us 🙂 ) when making a financial decision.

Why you need an emergency fund - Orange Wealth

Posted at 10:32h, 27 September[…] – Are you adequately insured? By that I mean all things health, life and car insurance. […]